1. Gravitating from Local Loyalty to Global Preference

In 2018, Kenya’s top 10 websites blended local and global: Local news websites and SportPesa competed healthily with Google, YouTube, and Facebook.

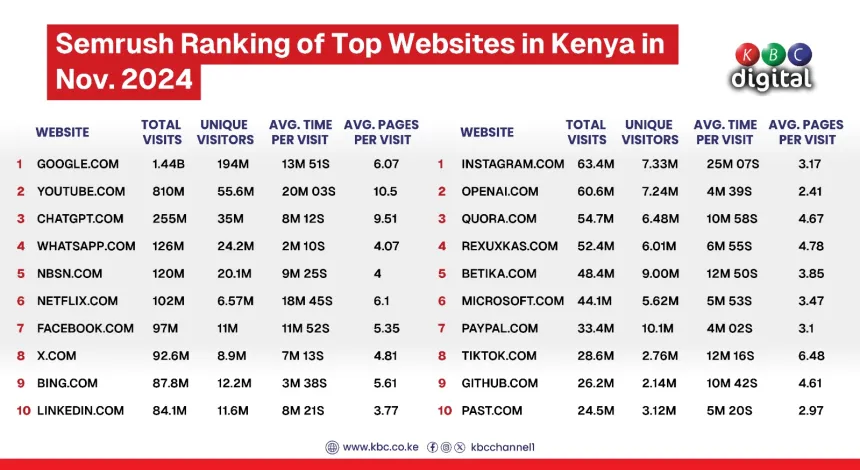

By 2021, the tides had turned. Global giants dominated; Google, YouTube, and Facebook held the top spots, with local media outlets pushed further down the list. And in 2025? The top five are entirely global platforms.

This is not a decline in local news demand but a seismic shift in how it is consumed. Kenyans now primarily access local content through social media feeds, messaging apps, and aggregators like Facebook and X (Twitter), bypassing traditional homepages. Kenyans still crave local content but discover it through algorithms, not homepages.

Kenyan users now prefer international platforms for search, streaming, social interaction, and productivity. This has led to KBC’s growth into a digital powerhouse since 2017. Reaching 25M Kenyans monthly and engaging 3M users online via social media channels of the 14 vernacular radio stations, TV channels, and bilingual sites. This hyperlocal, culturally rich content delivers unmatched national impact, especially where trust and language shape behavioural change.

However, our dependency on homegrown portals is shrinking fast, raising important questions about digital sovereignty and the long-term sustainability of local media and content ecosystems.

I believe you have read about Kenya’s struggling legacy media enterprises, which have led to the mass layoffs of many media professionals.

2. The Rise and Fall of Betting Culture

SportPesa’s 2018 peak (#10, with users spending over 18 minutes per visit) marked betting’s golden era. By 2021, betting sites like Betika and Odibets remained in the top 20 but with less grip.

Fast forward to 2025, and they are gone. The decline aligns with government crackdowns on betting and gambling advertising—but also reflects a subtle shift: Kenyans are now more invested in remote working, content creation & monetisation on global platforms & financial technology than gambling odds. Thus, fintech services like PayPal (#17) appear in 2025’s top 20. Pointing to a rise in digital finance tools, mobile payments, and fintech solutions for both business and individual users.

3. From Consumption to Creation

YouTube has been a consistent #2 across all years for entertainment and education, affirming Kenya’s deep love for video content. But the type of content is evolving.

In 2021, platforms like XVideos and XNXX were top 20 players, signalling high engagement with adult content, a digital contradiction to our conservative public discourse. However, in 2025, these sites vanished from the rankings, while Netflix (#6), TikTok (#18), OpenAI, and GitHub emerged.

Kenyans, especially Gen Z and young professionals, are no longer just scrolling for entertainment or escapism. They are learning, creating content, and coding. Whether using AI to draft reports, watching coding tutorials on YouTube, or building portfolios on GitHub, Kenya’s digital citizens have become more intentional.

4. The Social Media Fragmentation

While Facebook remained a top-10 constant (#6 in 2018 and #7 in 2025), the social sphere exploded with new players: WhatsApp Web rocketed to #4 (2025), signalling a surge in desktop-based messaging. TikTok debuted at #18, capturing Gen Z with short-form videos. Instagram (#11) and X/Twitter (#8) solidified niches for visual storytelling and real-time discourse. During this time, Kenyans have driven world-renowned social activism causes via Twitter, from causing CNN to apologise to the Gen Z protests & recently, a showdown with other nations such as Nigeria & Tanzania.

This shows growing fragmentation where Gen Z audiences, micro-influencers, and niche communities are now shaping content trends, reducing dependence on big, centralised platforms & traditional media platforms. This signals the need for more agile regulatory approaches that recognise digital diversity.

5. Kenya’s Digital Government

Public services such as eCitizen (#19) & KRA Tax Portal were in the top site rankings in 2018. Signalling a high demand for e-citizen services, digitised government programmes, and automated compliance systems. But by 2025, they are nearly absent. As fintech and e-governance platforms gain trust, the appetite for digital public infrastructure is growing, and policy must evolve to ensure accessibility, security, and trust.

6. Engagement Is Now More Focused—But Deeper

Time per session is declining across the board, but that is not a bad thing. It reflects a move from endless scrolling to intent-driven browsing. Platforms like ChatGPT, LinkedIn, and GitHub show a high depth of engagement per page even if overall session times are shorter.

Why This Matters for Policy

This behavioural evolution offers urgent lessons for both government and industry.

First, digital maturity is not driven by censorship; it is powered by access, literacy, and relevance. The disappearance of porn from top rankings likely owes more to rising alternatives (e.g., ChatGPT) than to regulations alone.

Second, Kenya’s emerging preference for AI tools, upskilling platforms, and professional communities shows the importance of localising and supporting indigenous innovations. If we want to lead in the next digital chapter, we must own more of the platforms we use, not just regulate what others create.

Finally, policymakers should take heed: user behaviour moves faster than regulation. By the time we react to what is trending, the trend has already shifted. A proactive approach rooted in homegrown tech, ethical AI, and public-private collaboration is our best bet for digital sovereignty.

By Mungai Charles