The Kenya Revenue Authority (KRA) has ordered all petroleum dealers nationwide to implement the Electronic Tax Invoice Management System (eTIMS) Fuel Station System by Wednesday, December 31, 2025. KRA commissioner-general Humphrey Wattanga. KRA had earlier set the deadline for compliance on Monday, June 30, 2025, but has since extended it after some dealers failed to comply. In a notice published on its social media pages and in the government newspaper MyGov, the taxman pointed out that the system is a specialised solution for the fuel business, enabling seamless, real-time billing for every transaction.

The government’s principal revenue collector noted that the system ensures accuracy and efficiency in tax reporting by integrating with KRA via a forecourt controller and current point-of-sale systems. “KRA reminds all petroleum product retailers of their obligation to implement the eTIMS Fuel Station System across their retail outlets. The compliance deadline for this requirement was June 30, 2025. The eTIMS Fuel Station System is a tailored solution for the fuel sector, enabling seamless, real-time invoicing for every transaction. It integrates with KRA through a forecourt controller and existing point-of-sale systems, thus ensuring accuracy and efficiency in tax reporting,” the notice reads. KRA warned that fuel station outlets that will not comply will face the full force of the law. “Retailers who fail to comply by Wednesday, December 31, 2025, will face enforcement measures as provided for under the law,” it cautioned. The authority reiterated its commitment to supporting and facilitating all fuel retailers in meeting the requirements of electronic tax invoicing.

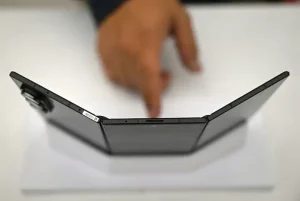

When was eTIMS introduced in Kenya? KRA launched the technology in 2023 to help traders transmit tax invoices in real time at their own convenience. It indicated that eTIMS is an update of the Tax Invoice Management System. On February 28, 2023, KRA declared in a public notice that it will give business owners the software for free in order to promote compliance. Petrol stations must implement eTIMS by December 31. The taxman noted that eTIMs is simple, convenient and adaptable to use as it can be accessed by many electronic and digital devices such as PCs and mobile phone apps. KRA deployed eTIMS as it embarked on an aggressive tax collection exercise to meet its revenue targets. How much did KRA collect in the 2024/2025 FY? In the 2024/2025 financial year, KRA collected KSh 2.571 trillion in tax revenue, surpassing its target of KSh 2.55 trillion. Domestic revenues climbed by 4.8% when KRA collected KSh 1.688 trillion versus a target of KSh 1.721 trillion, equating to a 98.1% performance rate. On the other hand, customs revenue reached a performance rate of 105.9%, with KSh 879.329 billion collected, against a target of KSh 830.368 billion.

By Japhet Ruto