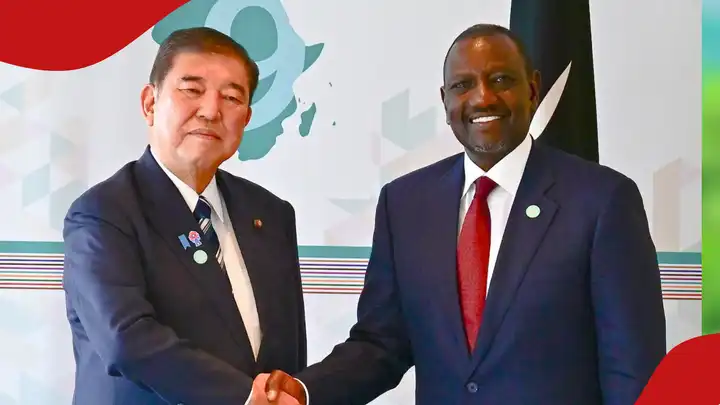

Japan will give Kenya up to 25 billion yen (KSh 22 billion) in Samurai bonds, which will be used to expand the country’s energy and vehicle assembly industries. President William Ruto (r) with Japan’s PM Shigeru Ishiba. Photo: William Ruto. Source: Twitter Nippon Export and Investment Insurance chief executive officer (CEO) Atsuo Kuroda and Kenyan Prime Cabinet Secretary (CS) Musalia Mudavadi signed the deal at the ninth Tokyo International Conference on African Development (TICAD 9). How Will Kenya spend the Japanese loan? The event was attended by President William Ruto and Japanese Prime Minister Shigeru Ishiba.

“At a ceremony graced by President William Ruto and Japan’s Prime Minister Shigeru Ishiba, Japan confirmed its intent to extend up to 25 billion yen (about KSh 22 billion) Samurai financing to Kenya. This facility will strengthen our local vehicle assembly and parts manufacturing industry while also addressing electricity transmission and distribution losses, currently standing at about 23% of our national output,” Mudavadi revealed on his official X handle. According to Mudavadi, the funds would spur innovation in the automotive industry, particularly the production of electric cars, promote industrial growth and create high-quality jobs. He also said it will strengthen fiscal stability and increase energy efficiency to reduce power costs, freeing up more funds for the country’s national development plan. The declaration came after a term sheet for a NEXI-backed loan to Kenya in yen was signed on Wednesday, August 20.

Although precise details were not revealed, Bloomberg reported that Japan’s foreign ministry stated the loan will be NEXI-guaranteed, a framework intended to reduce the costs of sovereign finance. Prime CS Musalia Mudavadi signed the loan on Kenya’s behalf. What is Kenya negotiating with China? Elsewhere, Kenya is negotiating with China to extend repayment terms and convert some of its dollar-denominated loans into Yuan to alleviate the strain on state finances, according to Treasury Cabinet Secretary (CS) John Mbadi. China is Kenya’s largest bilateral creditor, and pays it over $1 billion (KSh 129.5 billion) every year. For the fiscal year that ended in June 2025, 25% of foreign debt servicing was made up of loan payments to the Export-Import Bank of China. What is the value of Kenya’s debt? Kenya’s public debt skyrocketed from $11,491.98 billion (KSh 11.49 trillion) in April 2025 to $11,511.72 billion (KSh 11.51 trillion) in May 2025, according to the Central Bank of Kenya (CBK). During the review period, the country’s external debt increased from $5,327.88 billion (KSh 5.33 trillion) to $5,308.18 billion (KSh 5.32 trillion). Domestic debt grew from $6,164.10 billion (KSh 6.16 trillion) to KSh 6.4 trillion.

Source: TUKO.co.ke