The World Bank has listed conditions that Kenya must meet before releasing a $750 million (KSh 96.9 billion) loan to Kenya. President William Ruto with the World Bank president Ajay Banga (r). The global lender noted that once Kenya passes the necessary legislation and makes the required changes, it will release the billions of shillings. Business Daily reported that the Bretton Woods institution revealed it had imposed new conditions on Kenya, postponing the loan’s anticipated disbursement, originally set for the end of June 2025.

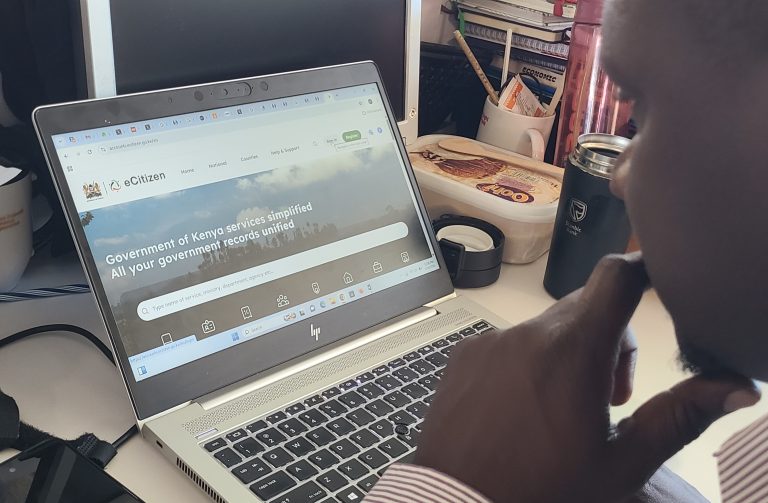

Which conditions did the World Bank impose on Kenya? Kenya’s Competition Act should be amended to tighten rules governing the activities of companies with dominant market shares. It wants Kenya to permit refugees to sign up for M-Pesa and mobile phone services. It wants regulations on sustainability-linked financing bonds. An urban transport policy that facilitates the decongestion of urban transportation and encourages city dwellers to use rail. The lender wants all government bank accounts to be kept at the Central Bank of Kenya (CBK) rather than dispersed among commercial banks. Full use of e-procurement to reduce corruption in government purchases of goods and services. Regulations supporting the implementation of the Conflict of Interest Act and the Social Protection Act. Further e-Government Procurement and Treasury Single Account (TSA) rollout. A structure to expedite the passage of the county governments’ additional allocations bills. Kenya Information and Communications Regulations. Amendments to the Forest Conservation and Management Act and the sovereign sustainability-linked financing framework.

How will new laws work in Kenya? The social protection law requires the national government and counties to establish an enhanced single registry (ESR) to provide cash transfers to the poor and vulnerable. The World Bank team. Photo: William Ruto. Source: Twitter The Conflict of Interest Act aims to prevent government officials with significant private sector interests from continuing to influence and profit from public procurement. World Bank representatives have met with National Assembly Speaker Moses Wetang’ula and Treasury Cabinet Secretary John Mbadi to expedite the implementation of the measures. In June 2024, Kenya and the World Bank signed a three-year DPO funding agreement, with the international lender making an initial transfer of $1.2 billion (KSh 155 billion). According to the multilateral lender, Kenya is unable to renegotiate the agreement, meaning it must adhere to the terms to receive more funds or risk having the three-year facility revoked. Is IMF negotiating a new loan with Kenya? As Kenya continues to engage the World Bank, it is also in discussions with the International Monetary Fund (IMF) on a new funded programme. The IMF also delayed releasing new funds to Nairobi over concerns that the National Treasury manipulated the Kenyan shilling. This occurred weeks after an IMF delegation concluded preliminary talks in Nairobi without reaching a staff-level agreement.

By Japhet Ruto