The government has signed a bilateral agreement with Belgium aimed at eliminating double taxation and preventing tax evasion for individuals and businesses operating between the two countries.

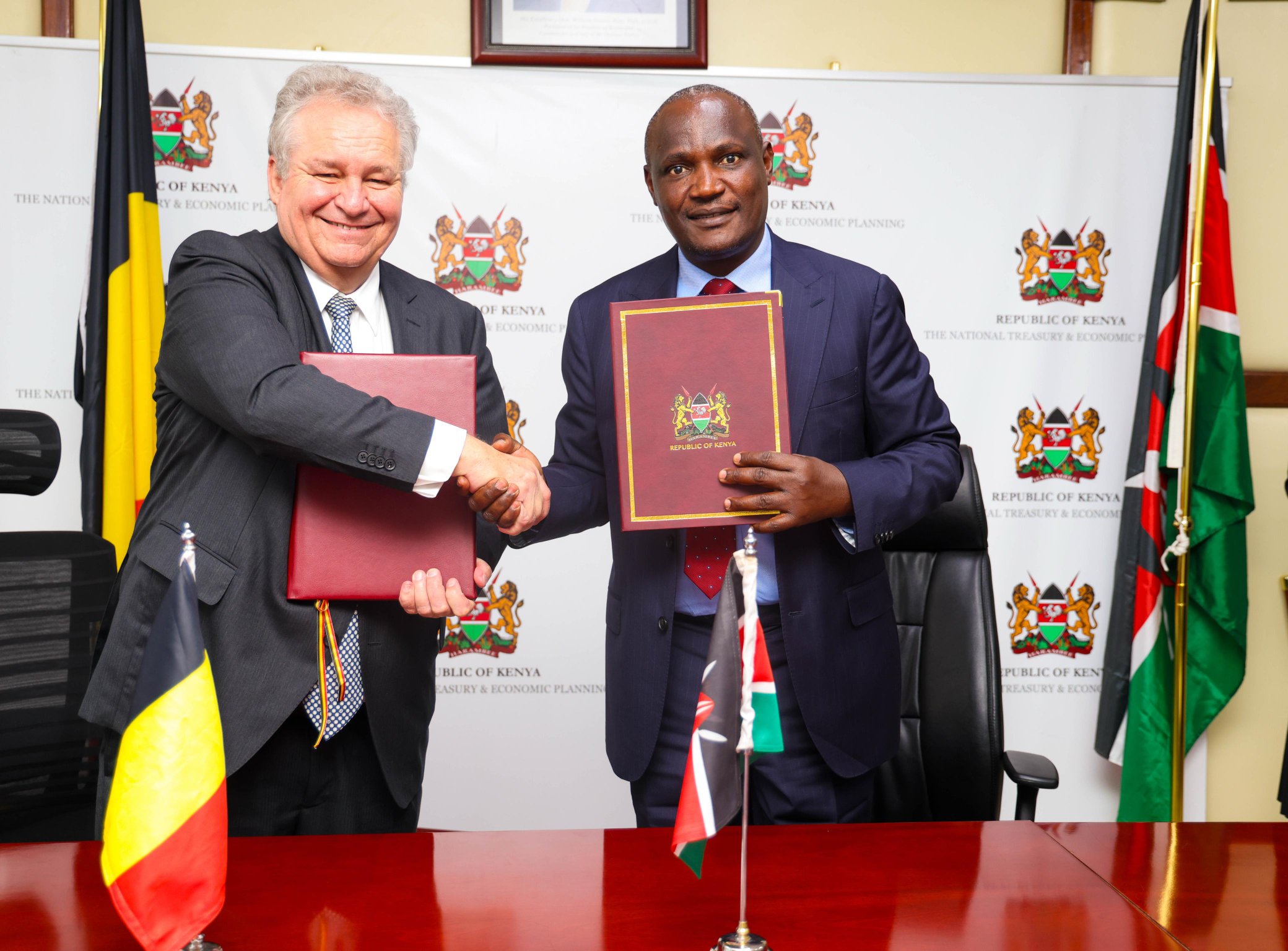

The deal was signed on Tuesday, September 30, at the National Treasury offices in Nairobi.

The agreement marks a significant step in strengthening Kenya-Belgium economic and investment ties.

Present at the signing ceremony were Treasury Cabinet Secretary John Mbadi and Belgium’s Ambassador to Kenya, Peter Maddens.

Speaking shortly after the signing, CS Mbadi emphasised the importance of the agreement in ensuring tax certainty and fairness.

He stated that the framework is designed to eliminate double taxation, create predictability in tax matters, and foster cross-border economic activity.

According to Mbadi, the deal also aims to tackle tax evasion and foster a more transparent and equitable tax system between the two nations.

Mbadi highlighted the broader goal of the agreement, stating that it will encourage more bilateral investment and solidify diplomatic and economic relations.

“This signing builds on the momentum of the 2024 Kenya-Belgium Political Consultations in Brussels, during which both countries reaffirmed their commitment to broaden cooperation in trade and investment,” Mbadi affirmed.

The Cabinet Secretary pointed to Kenya’s current economic performance, noting that the country’s nominal GDP stands at Sh15 trillion ($121.3 billion) as of 2024.

He attributed this growth to sound macroeconomic policies and a vibrant services sector, which continues to play a central role in Kenya’s economic resilience.

Mbadi also cited Kenya’s geographical advantage as a regional trade and logistics hub, along with its skilled workforce, as key factors that make the country attractive to foreign investors.

Ambassador Maddens welcomed the agreement, describing it as a strategic milestone in the diplomatic and economic relationship between Kenya and Belgium.

He said the deal fills a key gap in the bilateral framework and opens up new opportunities for cooperation in trade, business, and investment.

The signing follows a similar agreement between Kenya and the Czech Republic, which was concluded just a week earlier.

On Tuesday, September 23, the Treasury confirmed that CS Mbadi signed a double taxation avoidance agreement with Czech Ambassador Nicol Adamcová.

These back-to-back deals reflect the government’s continued effort to attract foreign investment and streamline cross-border tax policies.

by JANET ONYANGO