The Kenya Revenue Authority (KRA) has introduced a new electronic platform for landlords and property owners in a bid to simplify the collection of rental income tax and boost compliance.

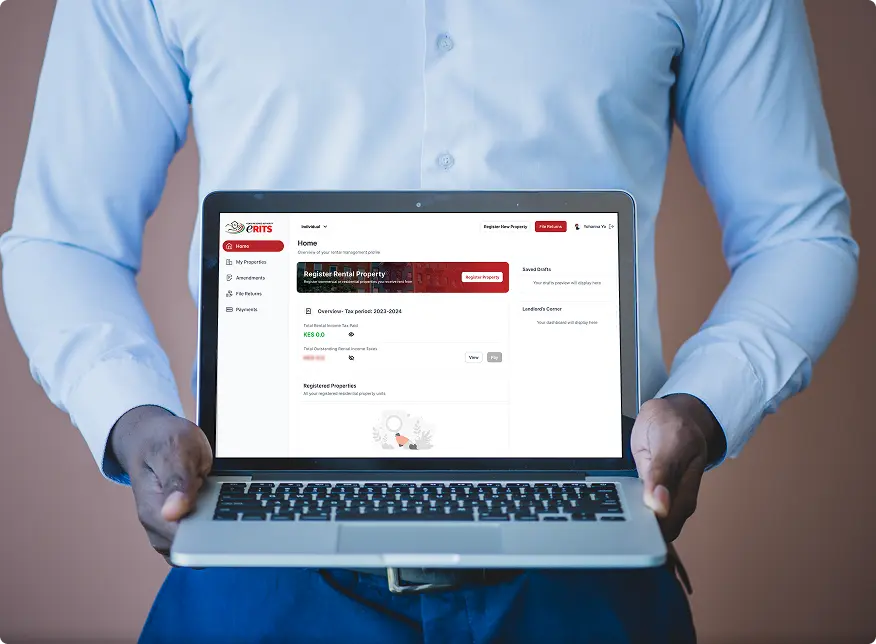

In a public notice issued on September 25, 2025, KRA announced the rollout of the Electronic Rental Income Tax System (eRITS), which will facilitate easier filing and payment of Monthly Rental Income (MRI).

The tax authority said the system is designed to make property management, filing of returns, and payment of taxes more efficient, while also ensuring accuracy in taxpayer records.

The system can be accessed via https://erits.kra.go.ke or through the eCitizen portal. All persons earning rental income are required to update or correct their property details through the new platform.

KRA emphasized that the move is part of ongoing reforms aimed at digitizing tax services and ensuring landlords meet their obligations under the law.

“Rental income tax is a key component of national revenue, and KRA is committed to supporting taxpayers with simplified digital solutions that ease compliance,” the Commissioner General said in the notice.

Kenya’s tax laws stipulate that rental income earners must pay tax monthly, and failure to comply attracts penalties and interest.

By migrating to eRITS, landlords will have a more streamlined process for declaring and remitting taxes, potentially reducing loopholes that have in the past contributed to revenue losses.

KRA has provided several support channels, including an email contact centre (contactcentre@kra.go.ke), a dedicated phone and WhatsApp line (0711 099 999), and its official social media platforms, such as X (@KRACare) and Facebook (Kenya Revenue Authority). Taxpayers may also seek help at their nearest KRA offices.

The new rollout aligns with KRA’s broader strategy to expand the tax base by leveraging technology and improving transparency.

In recent years, KRA has adopted digital innovations such as iTax, electronic tax registers (ETRs), and now eRITS, to enhance efficiency in tax administration.

KRA also reminded the public that it does not use agents or charge fees for recruitment or registration of taxpayers, urging property owners to remain vigilant against fraudsters.

The launch of eRITS comes at a time when the government is under pressure to raise domestic revenue to fund public services and development projects.

By tightening rental income tax collection, KRA is expected to bring more property owners into the tax net and increase compliance levels significantly.

by FELISTERS ATYANG