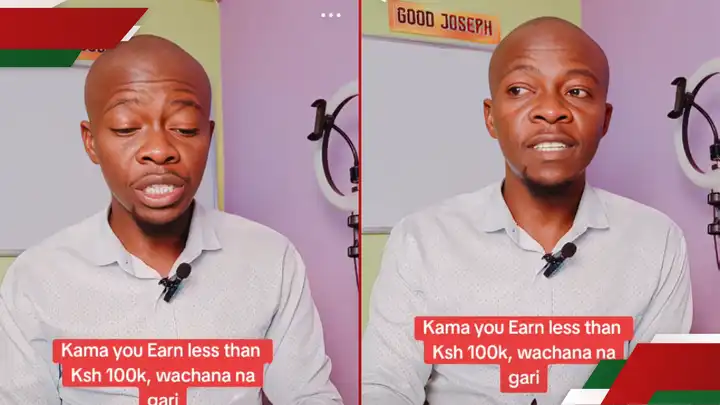

A Kenyan man has explained why anyone earning KSh 100,000 or less should not buy a car. Kenyan man advises people earning KSh 100k not to buy cars. Photo: Good Joseph. Source: TikTok Good Joseph broke down the expenses one would incur with a KSh 100,000 salary in an attempt to prove why purchasing a car would be a bad decision. Joseph, who advises people on personal finance, gave an example of a couple who sought advice as they were struggling financially. “I met a couple that earns almost KSh 90,000, and after analysing their expenditure, we concluded that they should not have purchased their car,” he shared.

He noted that most people buy cars on loans, which they have to service every month. As such, from a KSh 100,000 salary, the TikToker stated that one would need to pay roughly KSh 30,000 per month for the loan, approximately KSh 25,000 for rent, KSh 15,000 for shopping and groceries, as well as other bills and fuel for the car. According to his calculations, the individual would have nothing left to save, and the cycle would continue every month. “After analysing their expenditure and income, the couple decided to sell their car,” he said. Joseph clarified that owning a car is not a bad thing but explained that it would make more financial sense if it were for business, as it would generate income rather than being solely used for commuting to work. “Be careful, keen, and cautious. Otherwise, don’t rush to buy a car on loan only to have it repossessed,” he advised.

He urged Kenyans to analyse their finances carefully before making major purchases. Netizens react to buying cars Social media users had mixed opinions, with some agreeing that car ownership can be a financial burden, while others insisted that a car is a necessity and should be bought based on affordability. James Onyango: “Good education, but why not buy a car worth KSh 600k and pay in cash?” Obare Ishmael: “Is that KSh 100k gross or net pay? What if I earn KSh 100k and have no debts or loans?” Kemono Ruskin: “This is backward thinking. I bought my first car when my salary was less than KSh 30,000.” Caren Cheroh: “So, as a teacher, I should only think of a motorbike?” The Fat Prince: “A car is a basic need, especially with the recent rains.” Daniel Kariuki: “I don’t agree with you on the KSh 25,000 for rent.”

Jay: “Buy the car, do your day job, leave by 6 pm at the latest, and do Uber until 10 pm on weekdays. Spend more time on the weekends and use the money to offset the car loan. This makes sense in my head, but maybe the reality is different.”Monie: “You’ve just discouraged me, and I have been saving to buy my dream car, a Honda Vezel.” CreativeDive: “Owning a car is a must in Jesus’ name. You don’t have to buy a new one; you can always go for a second-hand.”

by Lynn-Linzer Kibebe