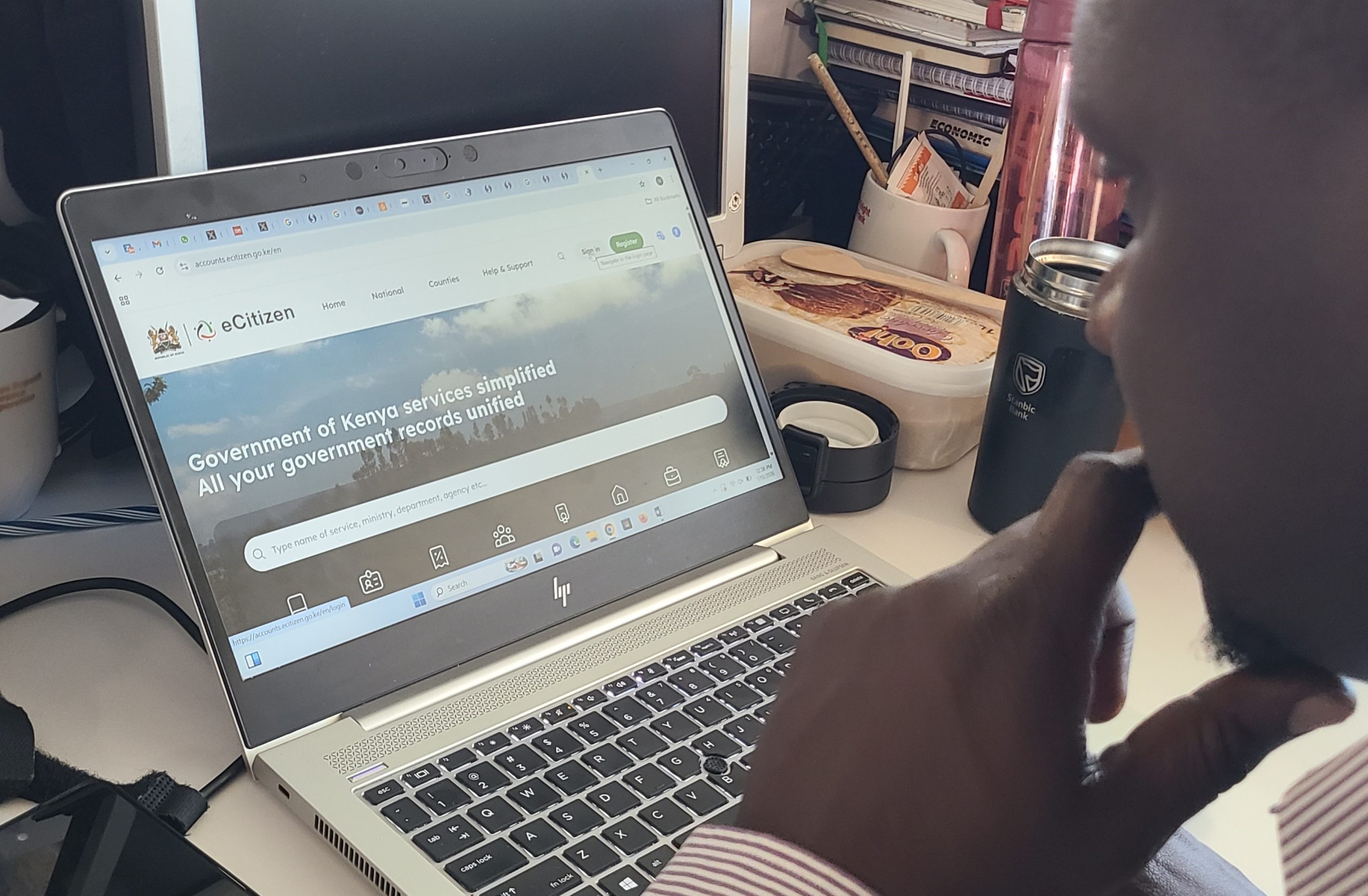

Digitisation of extra government services at the e-Citizen has pushed up government revenues six-fold to hit Sh8.2 billion monthly in 2025, according to new disclosures.

According to the Draft 2026 Budget Policy Statement, the platform generated Sh1.45 billion every month in 2022.

The latest disclosures show how the drive to digitise government services has quietly morphed into one of the National Treasury’s most effective revenue tools and plugged long-standing leakages in public finance.

Over the past three years, over 350 government agencies have been on-boarded onto e-Citizen, ranging from business registration and immigration services to land transactions, licences and regulatory approvals.

The platform, launched in 2013 as a pilot project between the National Treasury and the World Bank, initially offered just 10 services, today, with over 22,000 services available on eCitizen

“To modernise public service delivery, over 17,668 services were on-boarded onto the e-Citizen platform from over 350 agencies,” the BPS states.

Treasury says the result has been a sharp reduction in cash handling, discretionary charges and fragmented payment channels, areas long associated with revenue loss and corruption.

The exchequer notes that, the platform offers something traditional tax tools have struggled to achieve, real-time visibility of collections across ministries, departments and agencies (MDAs).

Payments are instantly logged, reconciled and transmitted to government accounts, closing gaps that previously allowed under-reporting or diversion of funds.

“The digitisation of extra 5,000 government services on the e-Citizen platform also reduced service turnaround times by 70 per cent,” reads the BPS.

It continues: “Digital platforms are no longer just about efficiency; they are now core instruments for fiscal discipline,” the BPS notes, linking automation directly to efforts to expand the tax base, seal revenue leakages and strengthen public financial management.

This digital tightening comes at a time of constrained fiscal space.

The BPS acknowledges that Kenya faces revenue underperformance pressures, rising expenditure demands and limited room for borrowing.

By September 2025, total revenue had fallen short of targets, forcing Treasury to plan supplementary budget adjustments.

Against this backdrop, the statement points to technology-enabled collection systems as a low-cost, politically safer alternative to new taxes.

Functions that were once controlled by individual ministries, departments and agencies are now more closely overseen by the Treasury through centralised systems.

This aligns with the government’s wider reform agenda, which includes full operationalisation of e-procurement, digitisation of payroll and pensions, and a gradual move toward accrual accounting.

“In the insurance and pensions sub-sector, the Government has advanced reforms aimed at expanding coverage, strengthening prudential regulation, and improving operational efficiency.”

“Digitisation and re-engineering of public sector pensions, including the Public Service Superannuation Scheme (PSSS) and non-contributory schemes, are underway to improve monitoring, ensure timely payments, and enhance sustainability,” the BPS notes.

The government has paired revenue digitisation with heavy investment in digital infrastructure.

Since 2022, Kenya has expanded its fibre-optic network to over 80,000 kilometres, rolled out thousands of public Wi-Fi hotspots, and connected hospitals and public institutions to high-speed internet.

These investments have been aiding the drive to automate 100 per cent of government services over the medium term.

The on-boarding of tax-related services has led to a shift in taxpayer behaviour, with more Kenyans now filing nil tax returns through the government’s eCitizen portal rather than the Kenya Revenue Authority’s iTax system.

by JACKTONE LAWI