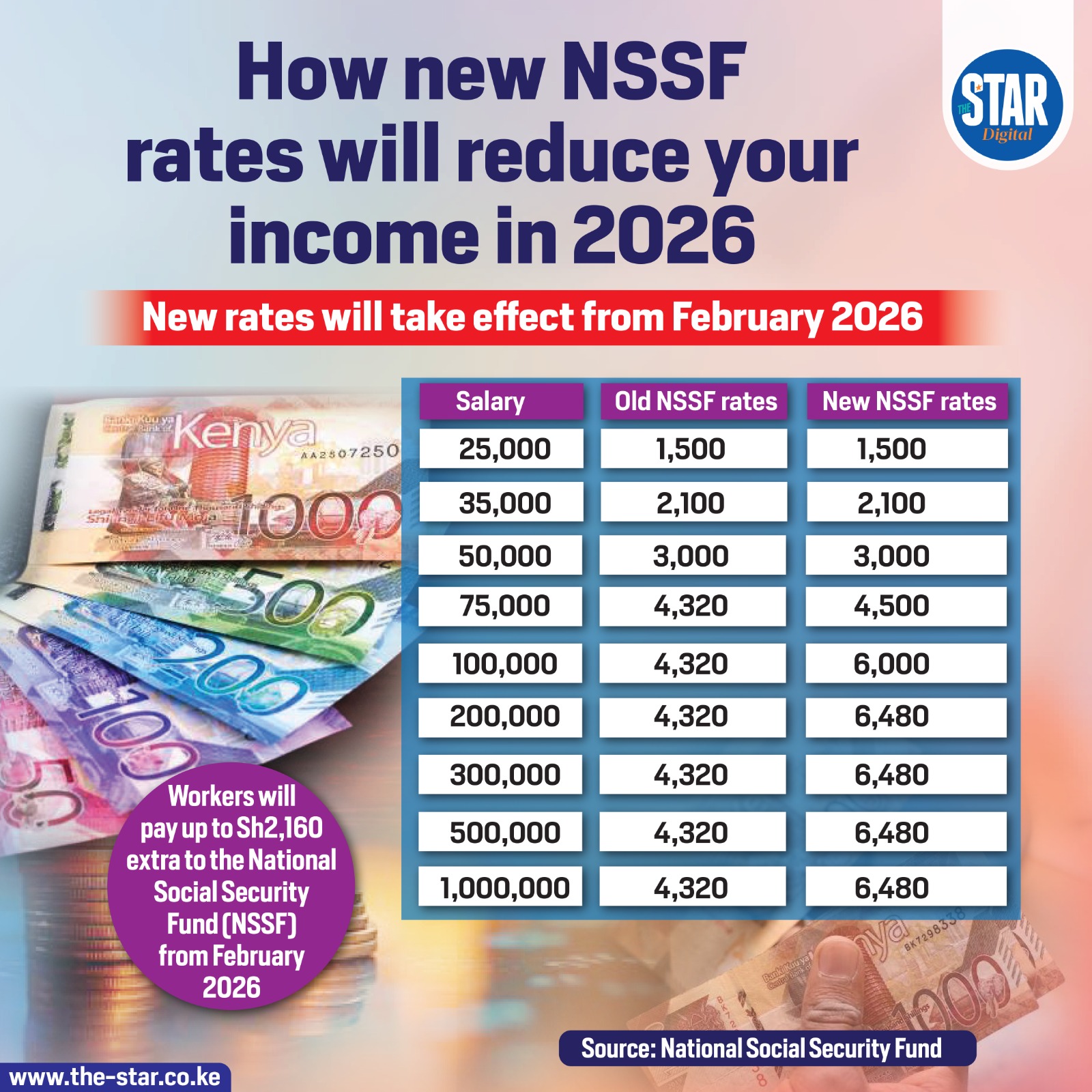

Beginning February 2026, Kenyan workers will see a shift in their take-home pay as the National Social Security Fund (NSSF) implements the next phase of its contribution scaling.

This adjustment is part of a multi-year plan to enhance the country’s social safety net, though it directly impacts the immediate disposable income of middle and high-income earners.

For those earning Sh50,000 or less, the contribution remains stable, capped at Sh3,000. However, the financial landscape changes for employees above this threshold.

A worker earning Sh75,000 will see their contribution rise from Sh4,320 to Sh4,500. The most significant jump occurs at the Sh100,000 salary mark, where deductions spike by nearly 40%, moving from Sh4,320 to Sh6,000.

For earners making Sh200,000 or more, the monthly deduction levels off at a new ceiling of Sh6,480.

by Rosa Mumanyi